Ok so we said we'd explain everything there is to know about fapiao, but frankly, we can't. The fapiao system is so complicated, labyrinthine and corrupt, we'd never get this thing done and we're writers, not tax accountants.

What we can do, however, is focus on giving you a broad understanding of how fapiaos work, and how they're likely to affect or be needed by most foreigners employed locally here in China.

If after reading this you still require more expert advice about fapiaos and your financial situation in general, please talk to a qualified accountant.

What is a fapiao?

A fāpiào (发票) may translate literally as "invoice" but it's a bit more complicated than that. According to SIRVA Policy Matter:

"A fapiao is an official invoice issued by the Chinese Tax Bureau (but provided by the seller) for any goods or services purchased within the country. The Chinese government uses these invoices to track tax payments and deter tax evasion."

A fapiao, then, is basically a goods and services receipt and a tax payment tracker rolled into one, and (to our knowledge) no exact equivalent exists in any other country in the world.

There are two types of fapiao:

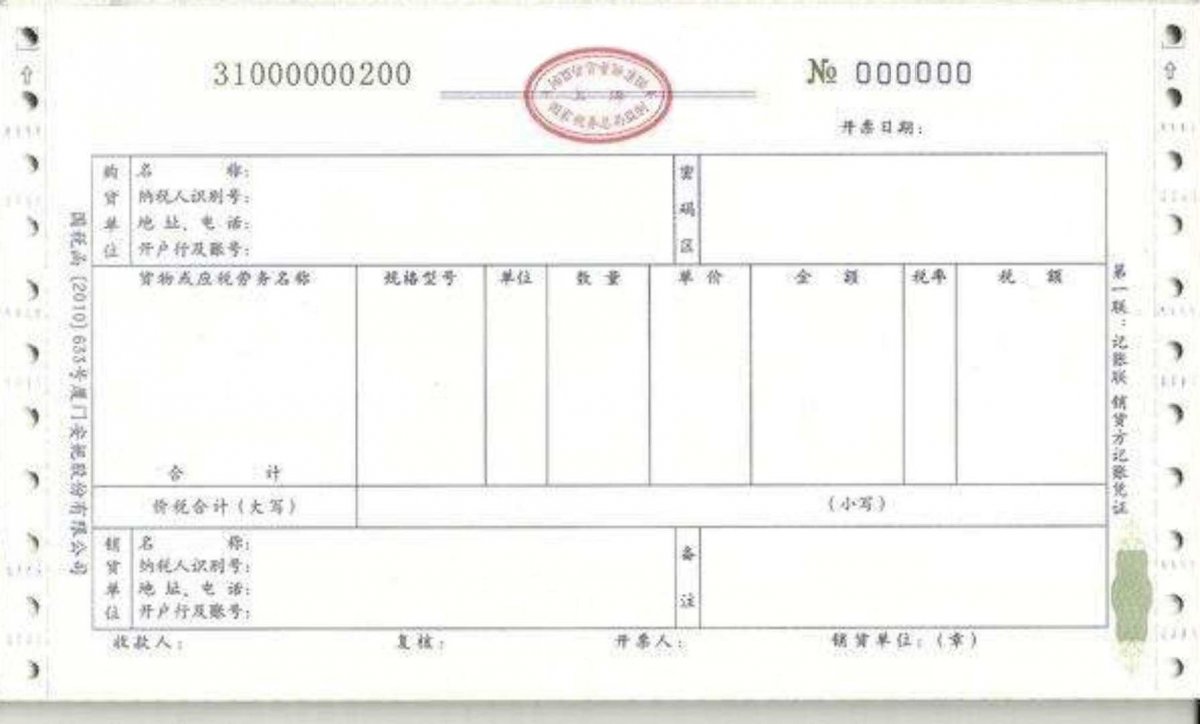

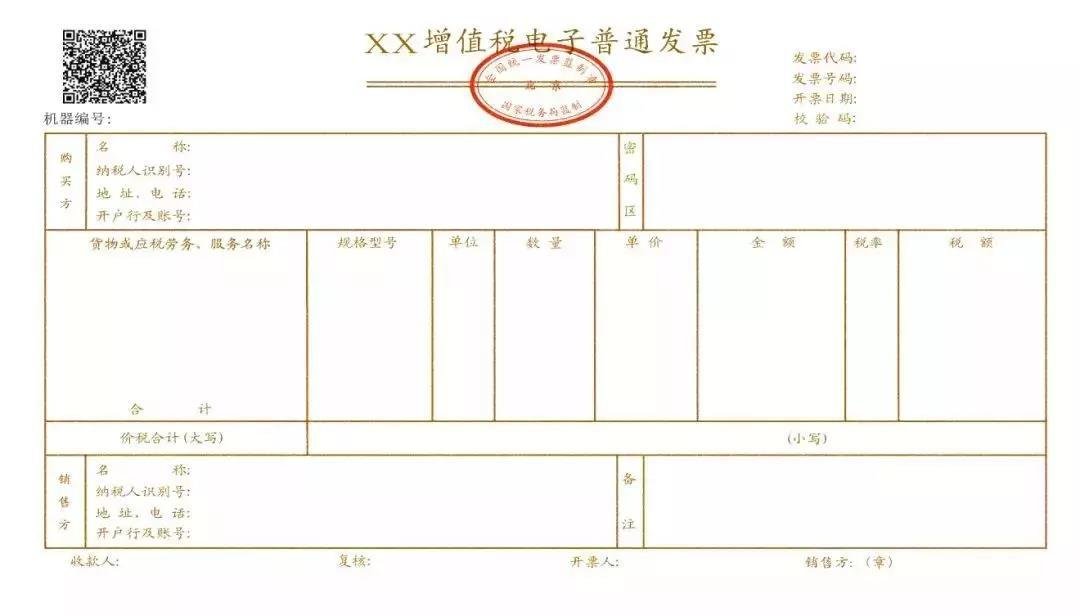

- General fapiao (增值税普通发票): simply evidence of payment (what you'll need to ask for most of the time)

- Special fapiao (增值税专用发票): used for tax deduction purposes, and contain detailed information, including the trader’s tax code, address, telephone number, and bank account information.

Fapiao are officially business records, so you'll need to ask for one whenever you need to prove a purchase or claim expenses. For a business, not generating and issuing them upon request is a serious transgression:

"If a company fails to produce a fapiao when requested to by a customer, this constitutes an illegal act, as all business transactions are required by law to be recorded on a fapiao."

"If a business owner is unable or unwilling to provide a fapiao, customers have to right to report the company to the local tax bureau."

Seems simple, right? Yet as any newcomer to China can attest, businesses big and small are notorious for either flat-out refusing to give you a fapiao or making the process very slow and painful. What gives?

Complying 100 percent with the fapiao system basically means paying more tax than companies that don't, and hey, nobody else is paying their taxes, so why should I? (See also: Greek debt crisis). At this point, tax evasion and fapiao fraud are so widespread, that pretty much nobody has their hands totally clean.

But before you go reporting non-compliant businesses left and right, consider this: it's possible that a business that refuses to give you a fapiao may be having difficulty getting a fapiao themselves, from suppliers further up the line. Issuing you a fapiao may throw their bookkeeping system out of whack. It's still not your problem, but worth bearing in mind.

What about e-fapiaos?

Since 2013, companies have been allowed to provide an electronic version of a fapiao that is just as valid as a regular paper fapiao, and can be printed out by the purchaser. However, due to higher trackability, e-fapiaos have not particularly caught on among general businesses, so you probably won't be getting one after dinner unless you are eating at Starbucks. Certain reputable companies may still be able to provide them, especially ones with a focus on online business.

Know your receipts

Why you should ask for a fapiao

You should ask for a fapiao if:

- You have made a business-related expense and need to be reimbursed for it.

- Your employee gives you an allowance for food or housing, and you need reimbursement for them.

- You need to keep track of large purchases for tax purposes.

You probably don't need a fapiao if:

- You've made a private expense (food, groceries, travel) that you don't need to justify, nor want to claim back at the end of the tax year.

- Your employer accepts other forms of expense records such as train tickets or electronic payment receipts.

There are a few gray areas. For example, many landlords in the private rental market don't want to issue fapiaos because they are probably declaring a lower rental income than what you are actually paying them. By forcing them to declare the true amount, you're also forcing them to pay more tax, not to mention putting them through the arduous bureaucratic process of filing for fapiaos. Also, fapiaos themselves cost approximately 5 percent of your monthly rent to issue. Therefore, they will try to pass the cost on to you, sometimes by increasing the rent or by taking an extra percent or two on the fapiao issue cost. While technically this is illegal, it is widespread and if you don't really need a fapiao for your rent, you may consider just letting the whole issue slide.

How/when to get a fapiao

To ask for a fapiao, say 可以给我开发票吗 kěyǐ gěi wǒ kāi fāpiào ma? "Can I have a fapiao please?" when settling your bill. The business will then ask you for the details of your company or your own details so they raise the fapiao. Having a business card on you can make this faster and easier. If the business is new, and they do not yet have a fapiao printer, they may ask if they can mail it to you later or for you to come pick it up. More and more businesses now provide a QR code for you to scan and input your own details, which can be beyond tricky if you're unacquainted with Mandarin. However, with a little pushback, you should be able to find someone to help out.

The WeChat mini-program 'Fapiao Helper' (search for "微信发票助手 wēixìn fāpiào zhùshǒu") can make this even easier. Simply input the company details (or ask someone in the accounts dept to set it up for you) and present this QR code to the businesses when you need a fapiao.

FAQ

Why do I see people selling fapiao online and on the street?

There is a roaring trade in the black market for counterfeit/fake fapiao, or 'genuine' fapiao that have not been used by the company to whom they were issued (think: "It fell off the back of a truck"). The maximum penalty for this kind of fraud is the death sentence (no joke), but because it is so pervasive, wide-spread and profitable, it's still considered by some to be a risk worth taking.

Why does my spouse always ask for fapiao for absolutely everything?

Well, basically, to commit tax fraud! Although perhaps they're just suspicious of the businesses she deals with and wants to be sure they are operating legally.

Why does somebody always ask for the fapiao when I dine out with a group of friends?

So they can use this fapiao to 'cover' some other expenses they have made that they need to claim back and didn't manage to get a fapiao for. Or just to straight-up claim this dinner. In both cases, this is fraud, but... very common.

Why can you use a totally unrelated fapiao (like a meal fapiao) to claim back expenses from a totally different purchase (like office supplies)?

Technically, you can't. This is fraud, but again very common.

How can I verify if an e-fapiao is authentic?

Local tax bureaus provide an e-fapiao search platform that lets you input certain details to check that they are authentic.

I used a dinner fapiao to 'cover' some business expenses, am I going to jail?

Under Chinese law, such minor offenses are often punishable by a fine, although further means can be employed to punish the "person directly responsible" for the company.

Now you're (kinda) an expert! But don't get too used to the system... Chinese cities are testing out using blockchain technology, renowned for its immutable and incorruptible record-keeping, to do away with the paper invoice fapiao system and hopefully, end this kind of tax evasion corruption for good.

Did we miss anything? Post your comments and questions below!

READ: ICYMI: A Guide for Americans on Voting From Abroad

Images: Inside Self Storage, All Business Templates

This is a place for show life about china, If these articles help you life better in china, Welcome to share this website to your friends, Or you can post questions about china life in FAQ, We will help you to find the right answer.

Recent Comments